Withdrawal Process with Exness in African Markets

Home » Withdrawal

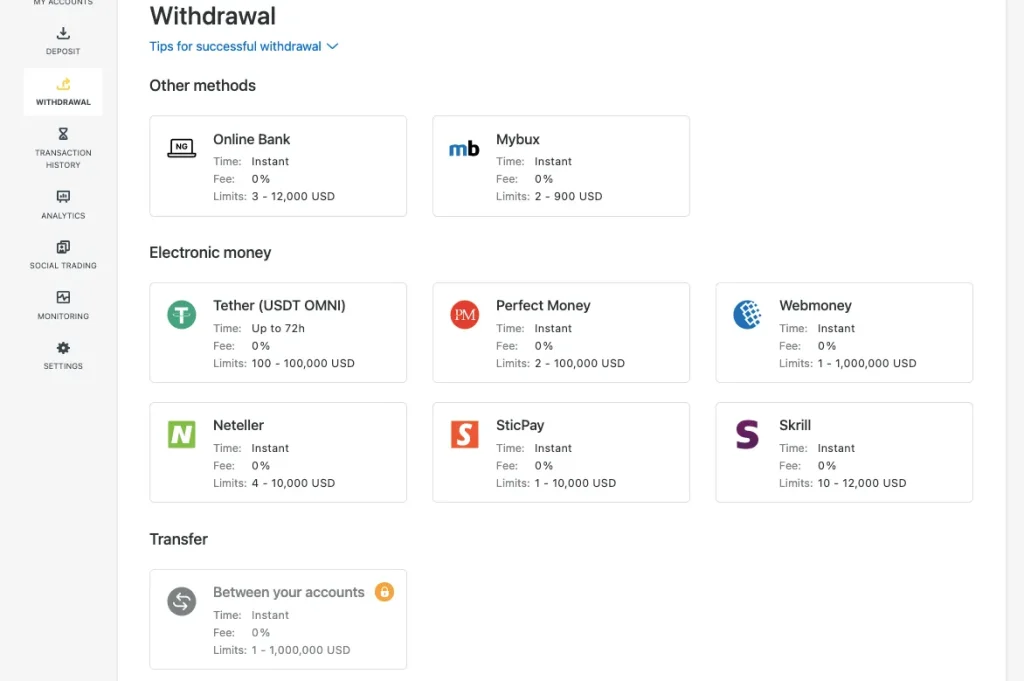

Withdrawal Methods Available

Exness provides multiple withdrawal options for African traders. These methods align with regional financial systems and banking infrastructure. The platform prioritizes accessibility and processing efficiency for fund retrievals.

Mobile money services function as primary withdrawal channels in many African countries. These include M-Pesa, MTN Mobile Money, and Airtel Money where regulatory permissions exist. Mobile money withdrawals typically process within 24 hours depending on service provider timelines.

Bank transfers deliver funds directly to personal bank accounts across African nations. Processing times vary by country and specific bank, typically ranging from 1-5 business days. International transfers may require additional processing time due to intermediary banking procedures.

Electronic Withdrawal Options

Electronic payment systems offer alternative withdrawal channels. These include Skrill, Neteller, Perfect Money, and similar services with African market presence. Processing typically completes within 24 hours after approval.

Cryptocurrency withdrawals allow fund retrieval through Bitcoin, Ethereum, and Tether networks. Transfer speeds depend on blockchain confirmation times and network congestion. The system requires wallet address verification before processing crypto withdrawals.

Payment cards support withdrawals to previously used deposit cards where regulatory framework permits. Card withdrawals typically process within 1-3 business days after approval. Some regional restrictions may apply based on card issuer policies.

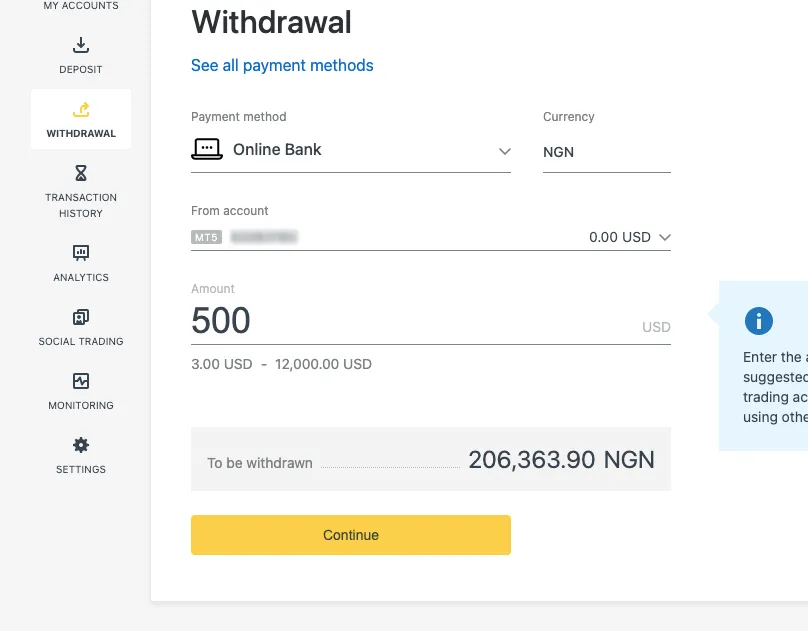

Withdrawal Request Procedure

The withdrawal process begins in the Personal Area secure dashboard. Users access this section through the main website or mobile application after authentication. The interface displays current account balances available for withdrawal.

Method selection displays available withdrawal options based on country, verification status, and previous deposit methods. The system prioritizes withdrawal to original deposit sources where possible. This approach maintains compliance with anti-money laundering requirements.

Amount specification requires entering the desired withdrawal value. The system displays both the requested amount and any applicable fees before confirmation. Minimum withdrawal amounts vary by method, typically starting from $10 or equivalent.

Verification Requirements

Withdrawal verification may include:

Identity confirmation through two-factor authentication codes

Additional security questions for large withdrawal amounts

Document verification for first-time withdrawal methods

Video verification in specific compliance cases

Processing Timeframes

Initial processing begins immediately after withdrawal request submission. The system performs automated verification checks during this stage. Most requests receive preliminary approval within minutes during business hours.

Compliance review occurs for withdrawals meeting specific criteria. These reviews ensure adherence to regulatory requirements and security protocols. Standard review processes typically complete within 24 hours during business days.

Final transfer execution times vary by withdrawal method:

Internal transfers between Exness accounts process instantly

Electronic payment systems typically complete within 24 hours

Bank transfers require 1-5 business days depending on location

Mobile money transfers usually complete within 24-48 hours

Cryptocurrency transfers depend on blockchain confirmation times

Withdrawal Limitations

Minimum withdrawal amounts vary by method. These minimums consider processing costs and operational efficiency. Typical minimum withdrawals range from $10 to $50 depending on the chosen method.

Maximum withdrawal limits depend on verification level, account history, and method constraints. Standard accounts without enhanced verification may face lower withdrawal limits compared to fully verified accounts.

Currency conversion occurs automatically when withdrawing to methods using different currencies than the trading account. Conversion rates follow current market rates with transparent fee disclosure before confirmation.

Withdrawal Fee Structure

Fee application depends on withdrawal method and amount. The platform absorbs many processing costs to minimize client expenses. Fee structures display clearly during the withdrawal request process.

Mobile money withdrawals may incur provider-based charges. These fees vary by country and service provider. The system displays applicable charges before final confirmation.

Bank transfer fees depend on destination bank and country. International transfers typically incur higher fees than domestic processing. Some premium account types receive fee waivers for specific withdrawal methods.

Common Withdrawal Considerations

First withdrawal from new accounts requires additional verification. This enhanced security helps prevent unauthorized access. Documentation requirements include identity verification and proof of payment method ownership.

Profit withdrawal follows the same process as capital retrieval. No distinction exists between original deposits and trading profits during the withdrawal process. Tax obligations remain the responsibility of the individual trader according to local regulations.

Partial withdrawals allow keeping some funds in trading accounts while retrieving others. This flexibility helps maintain trading positions while accessing profits. The system automatically calculates available withdrawal amounts considering open position margin requirements.

Withdrawal Request Cancellation

Pending withdrawal cancellation remains possible before final processing. Users access this option through the withdrawal history section in their Personal Area. Cancellation returns funds to the trading account immediately.

Processed withdrawal reversal requires contacting support services. Reversal possibility depends on method and processing stage. Some payment systems cannot recall transfers after final execution.

Alternative withdrawal selection becomes available after cancellation. Users may select different withdrawal methods without waiting periods. This flexibility helps address changing financial needs.

Mobile Withdrawal Functionality

Mobile application withdrawals offer:

Complete withdrawal function matching website capabilities

Streamlined interface optimized for smaller screens

Secure authentication through device-specific security

Push notifications for withdrawal status updates

Camera integration for document submission when required

Withdrawal Security Measures

Withdrawal address whitelisting restricts transfers to pre-approved destinations. This security feature prevents unauthorized withdrawals even if account access occurs. Adding new withdrawal destinations requires verification through email or SMS.

Two-factor authentication adds security through temporary verification codes. These codes deliver via email or SMS when initiating withdrawals. Authentication applies to all withdrawal requests regardless of amount.

Withdrawal confirmation emails provide transaction records and fraud prevention. These messages include transaction details and contact information for reporting unauthorized activity. Review these confirmations carefully to verify request authenticity.

Troubleshooting Withdrawal Issues

Rejected withdrawal resolution depends on the specific reason for rejection. Common causes include verification issues, insufficient funds, or payment method restrictions. The system provides rejection reasons through the Personal Area.

Delayed processing investigation begins after standard timeframes expire. Support services assist with tracking and resolution. Required information includes withdrawal reference numbers and method details.

Documentation updates may resolve verification-related withdrawal problems. The system specifies required documents when applicable. Submission occurs through the secure document upload function in the Personal Area.

Withdrawal Method Comparison

| Method | Processing Time | Minimum Amount | Fee Structure | Availability |

| Mobile Money | 24-48 hours | $10-$20 | Provider-based | Regional |

| Bank Transfer | 1-5 days | $50 | Bank-dependent | Worldwide |

| Electronic Wallets | 24 hours | $10 | Minimal/None | Most regions |

| Cryptocurrency | Network-dependent | $20 | Network fees | Unrestricted |

| Internal Transfer | Instant | No minimum | None | Between accounts |

| Payment Cards | 1-3 days | $10 | Card-dependent | Restricted regions |

Withdrawal Experience Analysis

| Aspect | Satisfaction Rating | Common Challenges | Resolution Approaches |

| Speed of Processing | 4.2/5 | Weekend delays | Submit during weekdays before cutoff times |

| Verification Requirements | 3.8/5 | Document rejection | Use scanning apps rather than photos |

| Fee Transparency | 4.5/5 | Provider-side charges | Review total cost before confirmation |

| Mobile Money Integration | 4.3/5 | Network synchronization | Allow 24-hour window for receipt |

| Bank Transfer Accuracy | 4.1/5 | Incorrect banking details | Triple-check information before submission |

| First Withdrawal Experience | 3.7/5 | Enhanced verification needs | Prepare documents before requesting |

| Large Amount Processing | 3.9/5 | Additional security reviews | Expect longer processing for significant sums |

| Support Responsiveness | 4.4/5 | Peak period delays | Use reference numbers in all communications |

FAQ: Preguntas Frecuentes

H3: Why was my withdrawal request delayed beyond the standard processing time?

Withdrawal delays typically stem from several identifiable factors. Verification inconsistencies between account details and banking information often trigger additional security reviews. Ensure your banking details exactly match your verified account information. Large withdrawals, particularly from recently funded accounts, undergo enhanced compliance checks to prevent fraudulent activity. First-time withdrawals to new payment methods require additional security verification regardless of amount. Regional banking system limitations occasionally create processing delays, particularly during local holidays or when using smaller financial institutions. Weekend withdrawal requests typically begin processing on the next business day. For fastest resolution, respond promptly to any verification requests through your Personal Area. Most delayed withdrawals resolve within 1-3 additional business days after providing requested information.

How can I reduce fees when withdrawing funds from African locations?

Fee optimization involves strategic withdrawal planning. Consolidate smaller withdrawals into fewer, larger transactions as minimum fees apply to each withdrawal regardless of size. Select local payment methods where available as international transfers typically incur higher charges from intermediary banks. Mobile money services often provide the most cost-effective option for many African regions despite percentage-based fees. Cryptocurrency withdrawals may reduce costs for larger amounts by avoiding traditional banking fees, though network charges apply. Consider the currency conversion impact when withdrawing to methods using different currencies than your trading account. Maintaining the same withdrawal methods consistently creates predictable fee structures rather than experimenting with multiple options. Some premium account types include reduced or waived withdrawal fees for specific methods, potentially justifying the minimum deposit requirements for frequent withdrawers.

What should I do when mobile money withdrawal shows completed but funds haven't arrived?

Mobile money receipt delays require systematic troubleshooting. First verify the transaction shows “Completed” rather than “Processing” in your Personal Area withdrawal history. Confirm the mobile number format includes the correct country code and follows proper formatting without additional zeros or symbols. Check alternative mobile money accounts if you maintain multiple registrations under the same name. Contact your mobile money provider directly with the transaction reference number from your withdrawal history to verify their receipt status. Network synchronization delays occasionally occur between financial systems, typically resolving within 24 hours. If funds remain undelivered after 48 hours with “Completed” status, contact support with the specific withdrawal reference number, recipient details, and confirmation screenshots. Most uncredited mobile money transactions resolve within 72 hours through provider communication channels.