Leverage Trading with Exness in African Markets

Home » Leverage

Leverage Mechanism Explained

Leverage allows traders to control larger positions with limited capital. This financial mechanism multiplies both potential profits and possible losses. Exness provides various leverage options for traders across African markets.

The system uses margin as collateral against leveraged positions. This margin represents the actual trader capital committed to each position. The remaining position value comes through a form of credit extended by the broker.

Leverage expresses as a ratio between total position size and required margin. A 1:100 leverage ratio means controlling $10,000 in market exposure with $100 actual capital. The precise amount of available leverage depends on account type and regulatory jurisdiction.

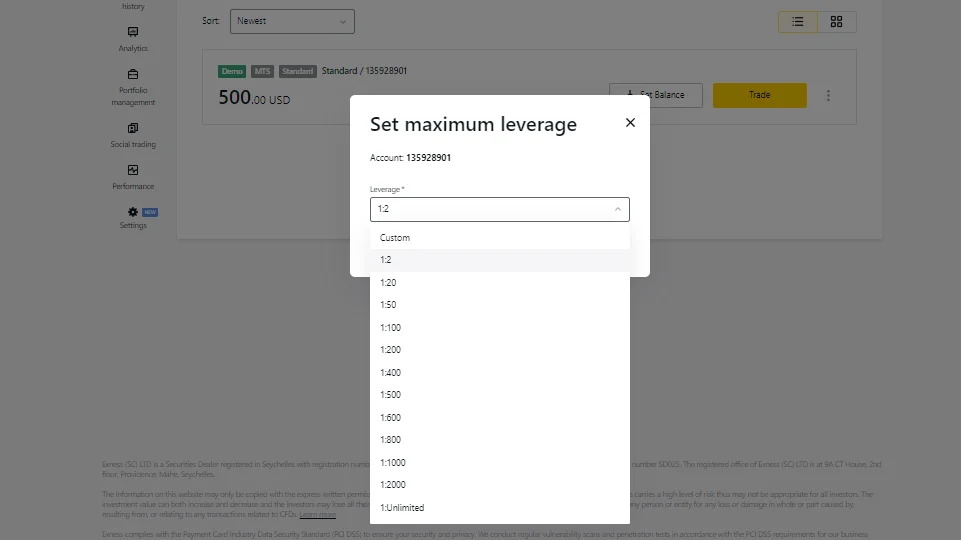

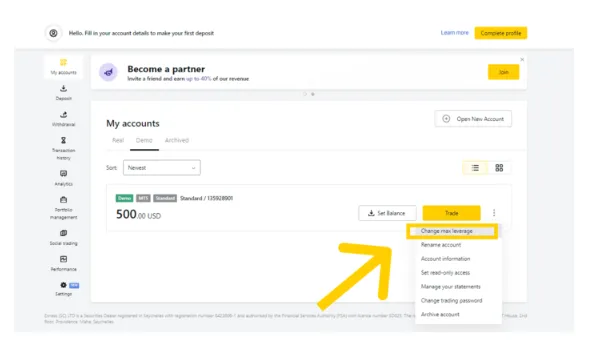

Leverage Ratios Available to African Traders

Standard account leverage starts at 1:unlimited in regions without specific regulatory restrictions. This unrestricted leverage allows maximum position sizing flexibility. Higher leverage increases potential returns but also magnifies possible losses.

Professional account configurations offer leverage options typically ranging from 1:100 to 1:unlimited. These accounts target experienced traders who understand leverage risk management. Verification requirements increase for accounts requesting higher leverage levels.

Regional variations exist based on local financial regulations. South African traders face different leverage restrictions compared to traders in Nigeria or Kenya. The platform automatically applies appropriate leverage based on verified residence information.

Instrument-Specific Leverage Limitations

Different trading instruments carry unique leverage restrictions:

Major currency pairs generally offer the highest available leverage, reaching maximum account levels in most cases.

Minor and exotic currency pairs may have reduced maximum leverage due to liquidity considerations and higher volatility.

Commodity CFDs typically provide moderate leverage with metals offering higher ratios than energy products.

Index CFDs operate with standardized leverage based on underlying market liquidity and volatility characteristics.

Cryptocurrency instruments maintain the lowest leverage limitations, usually capped at 1:2 to 1:20 due to extreme volatility.

Margin Requirements Calculation

Initial margin represents the capital required to open leveraged positions. This amount calculates as a percentage of the total position value determined by the leverage ratio. Higher leverage results in lower initial margin requirements.

Maintenance margin establishes the minimum account equity needed to keep positions open. This level typically sets lower than initial margin requirements. Positions face liquidation risk if account equity falls below maintenance margin levels.

Margin calculation follows this formula:

Margin Required = (Position Size / Leverage) + (Open Loss if any)

For example, opening 1 lot of EUR/USD (100,000 units) with 1:500 leverage requires $200 initial margin.

Margin Call Procedures

Margin call activation occurs when account equity approaches minimum maintenance requirements. The system issues warnings through platform notifications and email alerts. These warnings provide opportunities to either close positions or add funds.

The standard margin call level triggers at 50% of the required margin. This early warning system helps prevent forced liquidation. Traders receive notifications through multiple channels including platform alerts, emails, and mobile push notifications.

Stop out execution happens automatically when account equity falls below 30% of required margin. The system closes positions starting with the most unprofitable until margin requirements return to acceptable levels. This automation protects against negative balances during extreme market conditions.

Leverage Benefits for African Traders

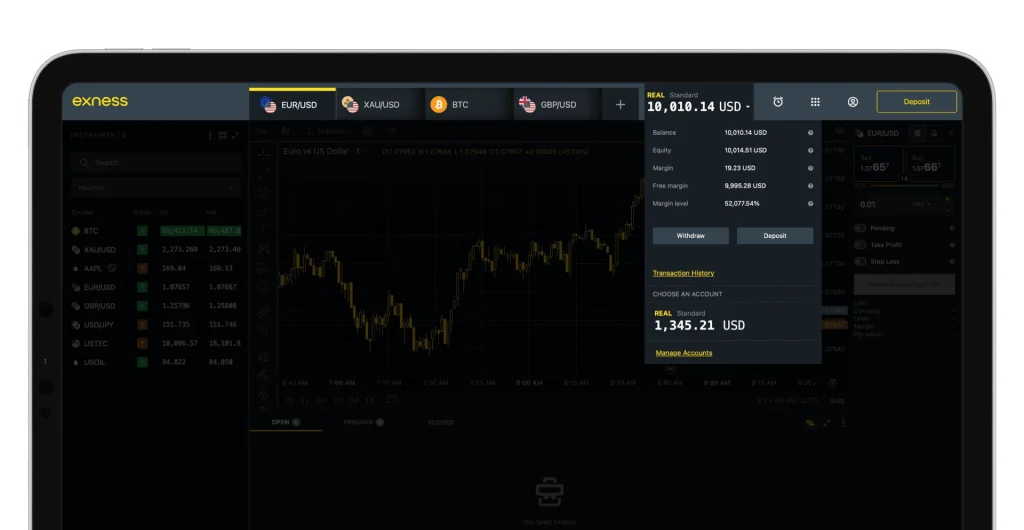

Capital efficiency allows participating in markets with limited starting funds. African traders access global markets with modest account sizes through appropriate leverage application. This accessibility opens trading opportunities otherwise unavailable with direct market participation.

Diversification becomes possible across multiple instruments even with smaller accounts. Leverage allows maintaining positions in different markets simultaneously. This diversification helps spread risk across uncorrelated assets.

Short-term opportunity capture works more effectively with leverage. Price movements too small for direct profit potential become viable with position amplification. Intraday strategies benefit particularly from this magnification effect.

Leverage Risk Factors

Accelerated capital erosion remains the primary leverage risk. Losses amplify at the same ratio as potential gains. A 2% market move against a 1:100 leveraged position creates a 200% impact on invested capital.

Margin call probability increases with higher leverage usage. Positions with minimal margin buffer face liquidation risk during normal market volatility. This risk increases during news events or unexpected market developments.

Psychological pressure intensifies when trading highly leveraged positions. Position values fluctuate dramatically with small market movements. This volatility can lead to emotional decision-making rather than strategic trading.

Leverage Management Strategies

Position sizing based on percentage risk rather than maximum available leverage. Professional traders typically risk 1-3% of account equity per position regardless of leverage availability. This approach prevents catastrophic losses from single trades.

Leverage reduction during volatile market conditions protects against unpredictable price movements. News releases, economic data publications, and political events warrant lower leverage utilization. These high-impact events often create price gaps and liquidity reductions.

Stop loss placement becomes critical with leveraged positions. Protective stops limit potential losses to predetermined levels. Proper stop placement considers both technical levels and account risk parameters.

Graduated Leverage Approach

Effective leverage management often follows tiered utilization:

Beginners should consider using 1:10 to 1:50 leverage maximum while developing trading skills.

Intermediate traders typically operate with 1:50 to 1:100 leverage with established risk management systems.

Advanced traders may use higher leverage when supported by comprehensive strategy testing and proven performance metrics.

Market condition adjustments reduce leverage during higher volatility periods regardless of experience level.

Regional Leverage Regulations

South African regulations through the Financial Sector Conduct Authority (FSCA) impose specific leverage restrictions. These limitations typically cap retail trader leverage at lower levels compared to some other African regions. Professional client classification may allow higher limits under certain qualification criteria.

Nigerian trading guidelines establish framework parameters for leverage offerings. The regulatory approach continues evolving as forex trading popularity increases within the country. Current structures allow variable leverage based on trader experience and account size.

East African markets including Kenya, Tanzania, and Uganda maintain their distinct regulatory approaches. These frameworks continue developing as financial markets mature in the region. Traders should verify current limitations through the legal documents section in their Personal Area.

Leverage Impact on Trading Costs

Spread costs scale proportionally with leveraged position sizes. Larger positions face higher absolute costs despite unchanged percentage values. This scaling affects trading strategy profitability, particularly for short-term approaches. Overnight financing increases with leverage as these charges calculate based on total position value. Positions held beyond daily cutoff times incur swap charges on the entire leveraged amount. These cumulative costs significantly impact longer-term position holding. Commission-based accounts experience proportional cost increases with leverage. Commissions typically calculate per standard lot traded, meaning larger positions generate higher absolute costs. These transaction expenses require consideration in overall strategy profitability analysis.Leverage Comparison Table

| Leverage Ratio | Margin Requirement | $1,000 Controls | Risk Level | Typical Application |

| 1:10 | 10% | $10,000 | Lower | Conservative positions |

| 1:50 | 2% | $50,000 | Moderate | Medium-term trading |

| 1:100 | 1% | $100,000 | Higher | Short-term strategies |

| 1:200 | 0.5% | $200,000 | Very High | Day trading/Scalping |

| 1:500 | 0.2% | $500,000 | Extreme | Specialized approaches |

| 1:1000+ | <0.1% | $1,000,000+ | Maximum | Expert use only |

Account Equity Protection Measures

Negative balance protection prevents account deficits regardless of leverage usage. This safeguard ensures traders cannot lose more than their deposited funds. The system automatically adjusts positions during extreme market conditions to maintain zero or positive balance. Guaranteed stop-loss orders provide execution certainty for defined risk parameters. These specialized orders execute precisely at specified levels regardless of market gaps or liquidity conditions. Available on select instruments, guaranteed stops may incur additional premiums. Margin Calculator tools help determine appropriate position sizing before trade execution. These calculators show required margin based on instrument, lot size, and applicable leverage. Regular margin requirement checking prevents overexposure during changing market conditions.Leverage Experience Matrix

| Trader Level | Optimal Leverage Range | Risk Management Focus | Common Challenges |

| Beginner | 1:10 – 1:30 | Position sizing discipline | Overtrading available margin |

| Intermediate | 1:30 – 1:100 | Correlation risk awareness | Inconsistent leverage application |

| Advanced | 1:50 – 1:200 | Strategy-specific adjustment | Psychological overconfidence |

| Professional | Varies by strategy | Portfolio-level exposure | System scaling limitations |

| Institutional | 1:5 – 1:20 | Risk-adjusted performance | Regulatory compliance complexity |

| Automated Systems | Strategy dependent | Drawdown circuit breakers | Connectivity-based execution risk |

FAQ: Preguntas Frecuentes

How does leverage affect different trading strategies in African markets?

Leverage impacts trading approaches differently based on timeframe and methodology. Day trading strategies often utilize higher leverage to capitalize on small intraday price movements that would otherwise generate minimal returns. The compressed timeframe reduces prolonged exposure to market risk but requires strict discipline in position sizing. Swing trading approaches typically function better with moderate leverage (1:20 to 1:50) as positions hold through daily fluctuations requiring wider stop placement. Position trading with timeframes extending beyond weeks generally performs most safely with minimal leverage (1:5 to 1:10) to withstand normal market cycles without margin pressure. Technical traders focusing on chart patterns should consider volatility-adjusted leverage, reducing ratios during consolidation breakouts when price action may become erratic.

What common mistakes do traders make with leverage management?

Leverage mismanagement typically manifests through several identifiable patterns. Position sizing based on maximum available leverage rather than percentage risk tolerance creates substantial overexposure to market movements. Many traders fail to adjust leverage during volatile market conditions when standard fluctuations may trigger unexpected margin calls. Trading multiple correlated instruments with full leverage creates position concentration risk as these markets often move similarly during economic events. Neglecting swap costs when holding leveraged positions overnight accumulates significant expenses that erode potential profits. Perhaps most critically, psychological factors lead traders to increase leverage following losing trades in attempts to recover losses quickly, often resulting in compounded negative outcomes. Effective management requires consistent position sizing regardless of recent trading results.

How can I determine the appropriate leverage for my trading approach?

Appropriate leverage selection follows a systematic evaluation process. Begin by calculating your risk tolerance per trade in percentage terms, typically 1-3% of account equity for sustainable trading. Determine the minimum price movement needed for your technical strategy to validate trade continuation or invalidation. Divide your percentage risk by this price distance to establish position sizing parameters. Select the minimum leverage ratio that allows executing this position size while maintaining at least 50% free margin after trade placement. Test this approach with consistent position sizing across at least 20-30 trades to evaluate outcome stability. Consider reducing standard leverage during scheduled news events or at month/quarter-end periods when market volatility often increases. Review and adjust your leverage approach quarterly based on actual trading results rather than hypothetical projections.