Legal Status of Exness in Africa

Home » Legal status

Regulatory Framework

Exness operates under specific regulatory guidelines across various African regions. The company maintains compliance with local financial authorities where applicable. These regulatory relationships vary by country due to differences in national financial legislation.

The regulatory status impacts several operational aspects including leverage limits, available instruments, and client fund protection measures. Users must verify their country of residence during registration to access appropriate services within their jurisdiction’s legal framework.

Financial regulatory bodies monitor trading platforms to ensure fair operations and client protection. Exness adheres to these requirements through regular compliance audits and reporting procedures.

Country-Specific Regulations

South Africa classifies foreign exchange and CFD providers under Financial Sector Conduct Authority (FSCA) oversight. Traders from South Africa access the platform under these regulatory provisions. The regulatory framework imposes specific operational requirements and client protection measures.

Nigeria operates under Central Bank of Nigeria (CBN) and Securities Exchange Commission (SEC) guidelines for foreign exchange activities. These regulations establish operational parameters for trading platforms serving Nigerian clients.

Kenya, Tanzania, and Uganda maintain their distinct regulatory approaches through their respective financial authorities. Each country establishes specific requirements for trading platforms operating within their jurisdictions.

Licensing Status

Regulatory coverage varies across African nations with three primary classifications:

Directly regulated markets where Exness holds specific licenses from local authorities. These jurisdictions provide comprehensive regulatory protection under local financial laws.

Passported regulation markets where regional regulatory recognition applies through international agreements. These arrangements allow operation under recognized international regulatory standards.

Markets without specific forex trading regulations where international standards apply. In these regions, the company operates under principles-based compliance with international financial norms.

Client Fund Protection Measures

Segregated accounts separate client funds from operational capital. This separation ensures client money remains distinct from company assets. Banking partners holding these funds maintain specific regulatory qualifications.

Negative balance protection prevents account deficits during extreme market volatility. This safeguard ensures traders cannot lose more than their deposited capital regardless of market conditions or position sizes.

Verification procedures follow international Anti-Money Laundering (AML) and Know Your Customer (KYC) standards. These protocols verify client identity and source of funds to prevent financial misconduct.

Compliance Requirements for Traders

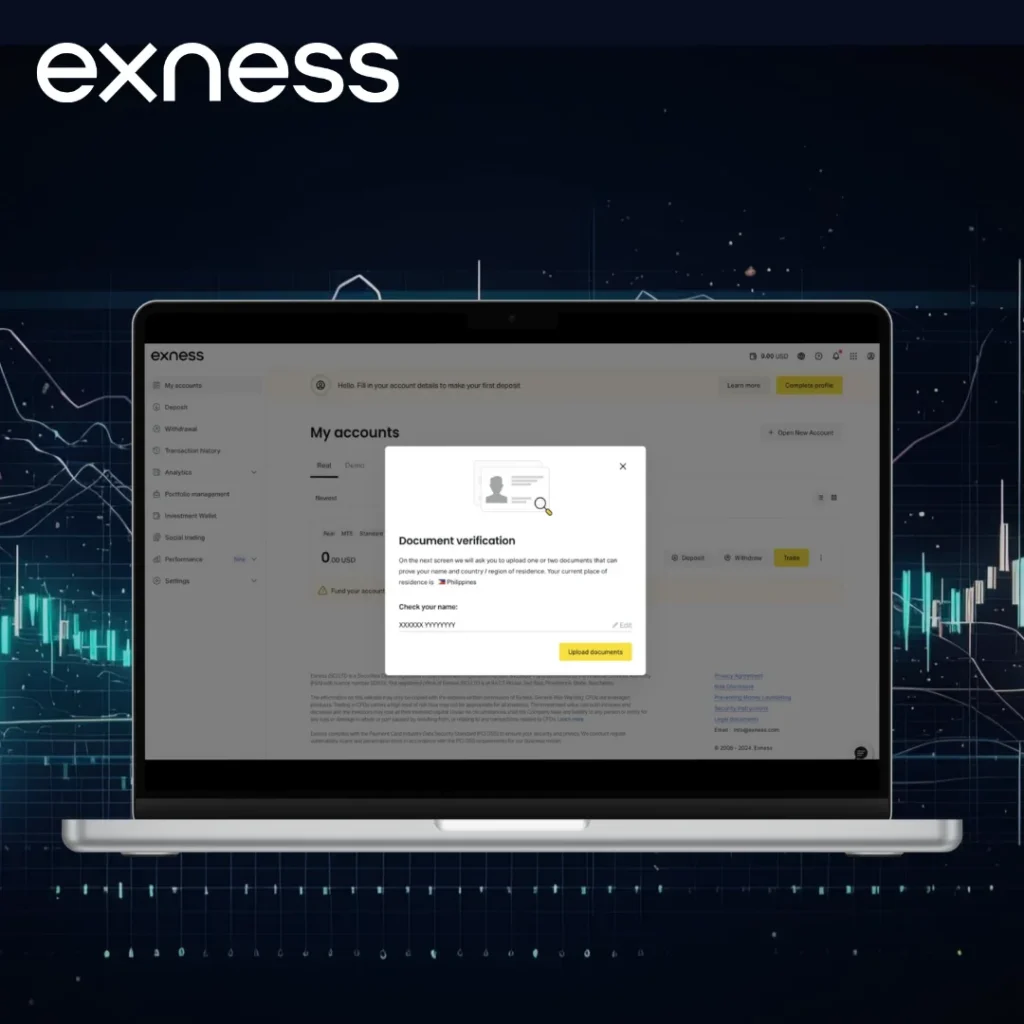

Identity verification requires government-issued documentation such as passports, national identity cards, or driver’s licenses. These documents must remain current and clearly legible. The verification system accepts digital submissions through the secure Personal Area.

Proof of residence verification needs utility bills, bank statements, or government correspondence dated within three months. The documentation must show the trader’s full name and current address matching registration details.

Source of funds verification may apply to larger deposits or withdrawals. This process ensures all financial transactions comply with international financial regulations and local requirements.

Age Restrictions and Account Access

Legal trading age requirements follow local regulations across different African countries. Most jurisdictions set minimum age at 18 years for financial trading activities. The registration process includes age verification steps.

Third-party account access faces strict limitations under regulatory guidelines. Account holders must personally manage their trading activities without delegating control to unregistered individuals. Corporate accounts require specific documentation establishing authorized representatives.

Inheritance and account transfer processes follow specific protocols when account holders face incapacitation or death. These procedures require comprehensive legal documentation according to local inheritance laws.

Tax Implications for African Traders

Tax responsibility remains with individual traders based on their country of residence. The platform does not automatically withhold taxes but provides transaction records for reporting purposes. These records detail all trading activities, deposits, and withdrawals.

Profit reporting requirements vary across different African tax jurisdictions. Some countries classify trading gains as capital gains while others consider them income. The distinction affects applicable tax rates and reporting methodologies.

Annual trading statements become available through the Personal Area for tax filing purposes. These documents summarize yearly trading activity in downloadable formats suitable for tax authorities.

Cross-Border Transaction Regulations

Foreign exchange controls in certain African countries impact deposit and withdrawal processes. These regulations may limit transaction sizes or require additional documentation for cross-border money movements.

Local currency conversion follows central bank regulations where applicable. Some jurisdictions require specific reporting for currency conversions exceeding certain thresholds. The platform facilitates compliant conversion processes where permitted.

International sanctions compliance ensures all transactions adhere to global financial regulations. The system automatically screens transactions against applicable sanction lists to prevent regulatory violations.

Dispute Resolution Procedures

Client complaints follow structured resolution protocols beginning with the support department. Initial response typically occurs within 24 hours with comprehensive case review. Complex issues may require additional investigation time.

Escalation procedures exist for unresolved disputes. These steps include review by specialized compliance teams with regulatory experience. Communication occurs through the secure messaging system in the Personal Area.

External dispute resolution operates through regulatory authorities in licensed jurisdictions. Traders may submit complaints to relevant financial regulators if internal processes fail to resolve their concerns.

Regulatory Compliance Comparison

| Aspect | Regulated Status | International Standards | Non-Regulated Market |

| Client Fund Protection | Mandatory segregation | Company policy | Company policy |

| Leverage Limits | Regulator defined | Company defined | Company defined |

| Reporting Requirements | Comprehensive | Limited | Minimal |

| Dispute Resolution | Regulatory oversight | Internal process | Internal process |

| Compensation Schemes | May be available | Not available | Not available |

| Trading Restrictions | More limitations | Moderate | Fewer limitations |

Terms of Service Compliance

Terms of Service establish the legal relationship between traders and the platform. These terms vary based on the specific Exness entity serving different African regions. All users must accept these terms during registration. Material changes to Terms of Service require notification through the Personal Area. Such changes typically include transition periods before full implementation. Users maintain responsibility for reviewing and understanding these updates. Prohibited activities include automated trading system abuse, arbitrage exploitation, and identity misrepresentation. Violation of these terms may result in account restrictions or termination according to the severity of the infraction.

Regulatory Experience Analysis

| Aspect | Efficiency Rating | Common Issues | Resolution Approaches |

| Document Verification | 3.7/5 | Image quality rejection | Use document scanning apps instead of photos |

| Processing Time | 3.9/5 | Delays during high volume periods | Submit during weekday business hours |

| Address Verification | 3.4/5 | Non-standard address formats | Include additional supporting documents |

| Corporate Registration | 3.2/5 | Missing company documentation | Prepare full documentation package before submission |

| Fund Source Verification | 3.8/5 | Insufficient transaction history | Provide bank statements covering 3-6 months |

| Regulatory Correspondence | 4.1/5 | Response delays for complex inquiries | Use categorized support tickets for faster routing |

| Compliance Updates | 3.9/5 | Adaptation to changing requirements | Review notification emails promptly |

FAQ: Preguntas Frecuentes

How do regulatory differences impact trading conditions across African countries?

Regulatory variations create distinct trading environments. Leverage restrictions differ significantly, with some countries limiting maximum leverage to 1:50 while others permit up to 1:unlimited. Available instruments may vary with certain markets restricting specific cryptocurrency or commodity offerings. Deposit and withdrawal methods reflect local financial infrastructure with regulatory approval. Verification requirements generally follow similar patterns but may include country-specific document types. Traders should review the specific conditions for their jurisdiction through the legal documents section in their Personal Area.

What documentation problems commonly affect African account verification?

Verification challenges often stem from document quality issues. Poor photographic resolution prevents automated verification systems from processing identification details. Expired documents receive automatic rejection, requiring current replacements. Name discrepancies between identification and proof of address documents create verification delays. Address verification proves particularly challenging in regions without standardized postal addresses. Submit high-resolution color images capturing all document corners. Ensure consistent name formatting across all submitted documents. Provide additional supporting documentation when standard address verification proves difficult.

How can traders ensure compliance with local currency regulations?

Currency regulation compliance requires several practical steps. Familiarize yourself with your country’s foreign exchange control regulations before trading. Some nations restrict the amount of local currency convertible to foreign currency annually. Maintain transaction records meeting local regulatory requirements for tax and audit purposes. Consider consulting with local financial advisors regarding specific reporting obligations. The platform provides transaction history reports suitable for regulatory documentation. Banking channels for deposits and withdrawals undergo periodic review to ensure continued regulatory compliance across different African markets.