Exness Trading Calculators for African Markets

Home » Calculator

Trading Calculation Tools Overview

Exness provides specialized calculation tools for trading decision support. These calculators help traders determine position parameters, potential outcomes, and risk factors. The tools work across different devices including those with limited processing capabilities common in African markets.

Each calculator focuses on specific trading aspects requiring numerical analysis. The calculations adjust automatically based on current market conditions. African traders use these tools to align trading decisions with their financial capacity and risk tolerance.

Calculator access occurs through both the trading platforms and the website. The tools maintain consistent functionality regardless of access method. Results appear instantly without requiring page refreshes or extended processing time.

Profit Calculator Functionality

The profit calculator determines potential gains or losses before trade execution. Users enter their intended position parameters including instrument, volume, and price levels. The system calculates expected outcomes based on these inputs and current market conditions.

Calculation factors include contract size, current market price, and applicable swap rates. The tool adjusts automatically for different account currencies. Results display in both account currency and percentage terms for clearer understanding.

African traders use this calculator to establish realistic profit expectations. The tool helps prevent position sizing errors that could lead to unexpected margin requirements. Calculations remain valid for both long and short positions across all available instruments.

Profit Calculation Formula

The system calculates profit using the following approach:

For buy positions: Profit = (Sell Price – Buy Price) × Lot Size × Contract Size

For sell positions: Profit = (Buy Price – Sell Price) × Lot Size × Contract Size

Additional adjustments apply for:

- Non-USD account currencies using current conversion rates

- Overnight positions including applicable swap charges

- Commission-based accounts with per-lot fees

Margin Calculator Applications

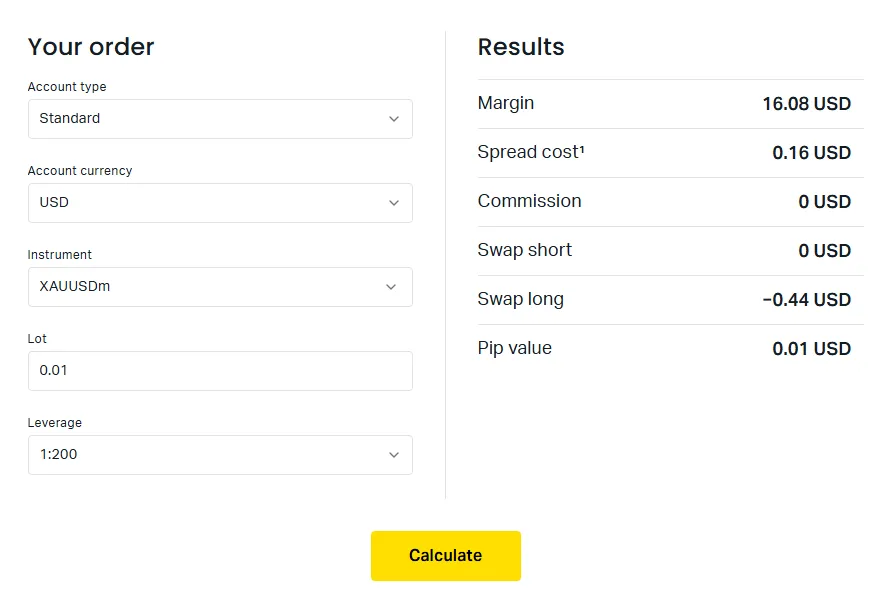

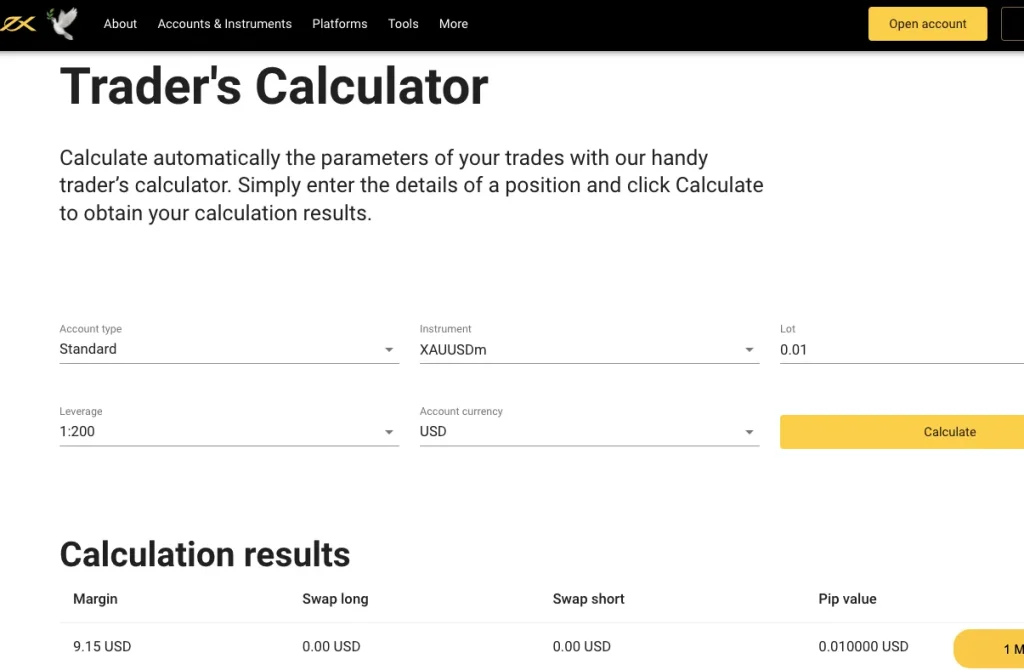

The margin calculator determines capital requirements for intended positions. This tool helps traders understand the financial commitment required before market entry. Calculator inputs include trading instrument, volume size, and account leverage.

Results show both initial margin requirements and maintenance levels. The calculator factors account currency, current market prices, and applicable leverage limitations. Different account types display appropriate margin calculations based on their specific conditions.

Margin calculation proves particularly valuable in markets with leverage restrictions. African regions maintain varying regulatory approaches to maximum leverage. The calculator adjusts automatically to show requirements specific to the user’s trading region.

Swap Calculator Operations

The swap calculator determines overnight holding costs for positions extending beyond the daily cutoff time. Swap rates vary between instruments and depend on interest rate differentials between currency pairs. The calculator shows both long and short position rates simultaneously.

Calculation inputs include instrument selection, position size, and holding duration. Results display costs for different timeframes including one night, weekends, and extended periods. The system factors triple-swap charges applied for positions held over weekends.

Swap costs affect long-term position profitability significantly. African traders use this calculator for both short-term trades and longer investment positions. The calculator updates rates automatically when underlying interest rates change.

Pip Value Calculator Function

The pip value calculator converts price movements into actual profit or loss amounts. This conversion depends on position size, account currency, and specific instrument characteristics. The calculator helps traders understand the financial impact of market movements.

Calculation inputs include trading instrument, account currency, and position volume. Results show the monetary value of each minimum price movement (pip). This value scales linearly with position size for most instruments.

Pip value calculations prove essential for proper stop-loss and take-profit placement. African traders use this information to align risk parameters with their account capacity. The calculator works for all currency pairs and CFD instruments available on the platform.

Calculator Integration with Trading Platforms

Platform calculators appear directly within the trading interface for immediate access. This integration allows calculation during order preparation without switching between applications. Results transfer automatically to order forms when applicable.

Mobile application calculators maintain full functionality despite screen size limitations. The interface adapts to different device dimensions while preserving calculation accuracy. Data entry occurs through optimized input methods appropriate for touchscreen interaction.

Web-based calculators function independently from trading platforms when needed. These tools require only basic browser capabilities without plugins or special requirements. The system supports older browser versions common in some African regions.

Risk Management Calculator Functions

Position size calculators determine appropriate lot sizes based on risk parameters. Traders enter their account balance, maximum acceptable risk percentage, and stop-loss distance. The calculator determines the maximum position size within these constraints.

Risk-reward calculators analyze potential trades for efficiency. The tool compares potential profit against possible loss based on entry price, stop-loss, and take-profit levels. Results display as ratio values helping traders evaluate trade quality objectively.

Drawdown calculators show potential account impact from losing trades. This projection helps traders understand possible negative scenarios before commitment. African traders use these calculations to maintain sustainable trading practices regardless of market conditions.

Economic Calculator Applications

Currency converter tools translate values between different currencies based on current exchange rates. This functionality helps traders understand position values across different denominations. The converter updates rates regularly to maintain accuracy.

Inflation calculators show purchasing power changes over time for different African currencies. These calculations help traders evaluate long-term investment strategies against inflation projections. Historical data provides context for current inflation trends.

Interest rate comparisons display current rates across different currencies. This information helps traders understand carry trade opportunities and swap rate determinants. African currency interest rates appear alongside major global currencies.

Calculator Accuracy Factors

Market data sources ensure calculation precision through real-time information feeds. The calculators connect to the same pricing engines used for actual trading. This connection maintains consistency between projected and actual outcomes.

Update frequency keeps calculations relevant during changing market conditions. Most calculators refresh data automatically at regular intervals without requiring manual intervention. Critical values update immediately when significant changes occur.

Calculation precision matches industry standards with appropriate decimal place display. The system rounds results according to instrument conventions and practical significance. More sensitive calculations maintain higher decimal precision when necessary.

Calculator Interface Design

Calculator interfaces prioritize clarity and ease of use with:

Simple data entry fields with clear labels

Dropdown menus for instrument selection

Results displayed prominently with relevant units

Context-sensitive help for each calculator function

Automatic field completion when possible to reduce input errors

Responsive design adapting to different screen sizes

Calculator Access Methods

Website calculators provide tool access without platform login requirements. These calculators appear in the public section of the Exness website. Users need only internet connectivity without account prerequisites. Platform-integrated calculators operate within MT4, MT5, and web terminal environments. These tools access account-specific information automatically for more personalized results. Login credentials provide access to these enhanced calculator functions. Mobile application calculators work on Android and iOS devices common in African markets. These tools optimize screen layout for smaller displays while maintaining calculation accuracy. Offline functionality allows some calculations without active internet connections.Calculator Comparison Table

| Calculator Type | Web Access | Platform Integration | Mobile Availability | Offline Function |

| Profit Calculator | Yes | Yes | Yes | Partial |

| Margin Calculator | Yes | Yes | Yes | Partial |

| Swap Calculator | Yes | Yes | Yes | No |

| Pip Value Calculator | Yes | Yes | Yes | Yes |

| Position Size Calculator | Yes | Yes | Yes | Yes |

| Risk-Reward Calculator | Yes | Yes | Yes | Yes |

| Currency Converter | Yes | Limited | Yes | No |

| Drawdown Calculator | Yes | No | Yes | Yes |

Practical Application Examples

Day traders use pip value and margin calculators for quick position sizing. These calculations occur immediately before market entry to ensure appropriate risk levels. Results help determine both position size and stop-loss placement within seconds. Swing traders rely on swap calculators for multi-day positions. These calculations project holding costs across the intended timeframe. African traders factor these costs into overall profit expectations for medium-term strategies. Long-term investors utilize inflation and interest rate comparisons. These tools help evaluate potential returns against economic factors. Calculations assist with currency pair selection for extended position holding.Calculator Utility Assessment

| Calculator Type | User Rating | Primary Benefit | Limitation Factors |

| Margin Calculator | 4.7/5 | Prevents margin calls | Requires understanding of leverage concepts |

| Profit Calculator | 4.5/5 | Sets realistic expectations | Cannot predict market direction |

| Position Size Calculator | 4.6/5 | Enforces risk discipline | Depends on accurate stop-loss placement |

| Swap Calculator | 4.3/5 | Projects holding costs | Rates subject to change without notice |

| Pip Value Calculator | 4.8/5 | Translates movements to money | Requires understanding of pip concept |

| Risk-Reward Calculator | 4.4/5 | Evaluates trade efficiency | Cannot assess probability of success |

| Drawdown Calculator | 4.2/5 | Stress-tests strategies | Creates psychological hesitation in some traders |

| Currency Converter | 4.5/5 | Simplifies cross-currency analysis | Requires regular rate updates |

FAQ: Preguntas Frecuentes

Why do calculation results sometimes differ from actual trading outcomes?

Result variations stem from several normal market factors. Slippage during order execution can cause entry or exit prices to differ from calculator inputs, especially during volatile market conditions. Spread fluctuations between calculation time and actual trading impact final outcomes as calculators use current spread values which may change. Overnight positions incur swap charges that accumulate over time, sometimes at variable rates if interest rate differentials change. Multiple partial closures of positions may create averaged entry prices different from original calculations. The most accurate results come from entering exact executed prices rather than planned entry levels. Consider adding a small buffer percentage to calculated margin requirements to account for market fluctuations.

How can I optimize calculator usage on limited internet connections?

Connection optimization involves several practical approaches. Perform complex calculations during stable connection periods and record the results for later reference. Use the mobile application’s offline calculators which function without continuous connectivity for basic calculations. Simplify calculation inputs to whole numbers where precise decimal values aren’t critical. The position size calculator and risk-reward tools function effectively offline once loaded. Create a personal calculation spreadsheet based on calculator formulas for completely offline use when needed. Pre-calculate common position sizes and respective margin requirements for your frequently traded instruments.

Which calculations prove most essential for beginning traders in African markets?

New traders should prioritize specific calculators for initial development. The margin calculator proves most fundamental, ensuring sufficient account funds before position opening. Position size calculators prevent overexposure by aligning trade size with account capacity and risk tolerance. Beginners should calculate potential loss amounts in actual currency values rather than abstract percentages to understand real impact. Start with calculating only 1-2% risk per trade until developing consistent results. Use the risk-reward calculator to ensure potential profits justify possible losses at minimum 1:1.5 ratio. Calculate overnight costs using the swap calculator before holding positions beyond day trading timeframes. Many new traders focus exclusively on profit calculators while neglecting risk measurement tools, leading to account management problems.