Exness Africa Mobile-Up

Home » App

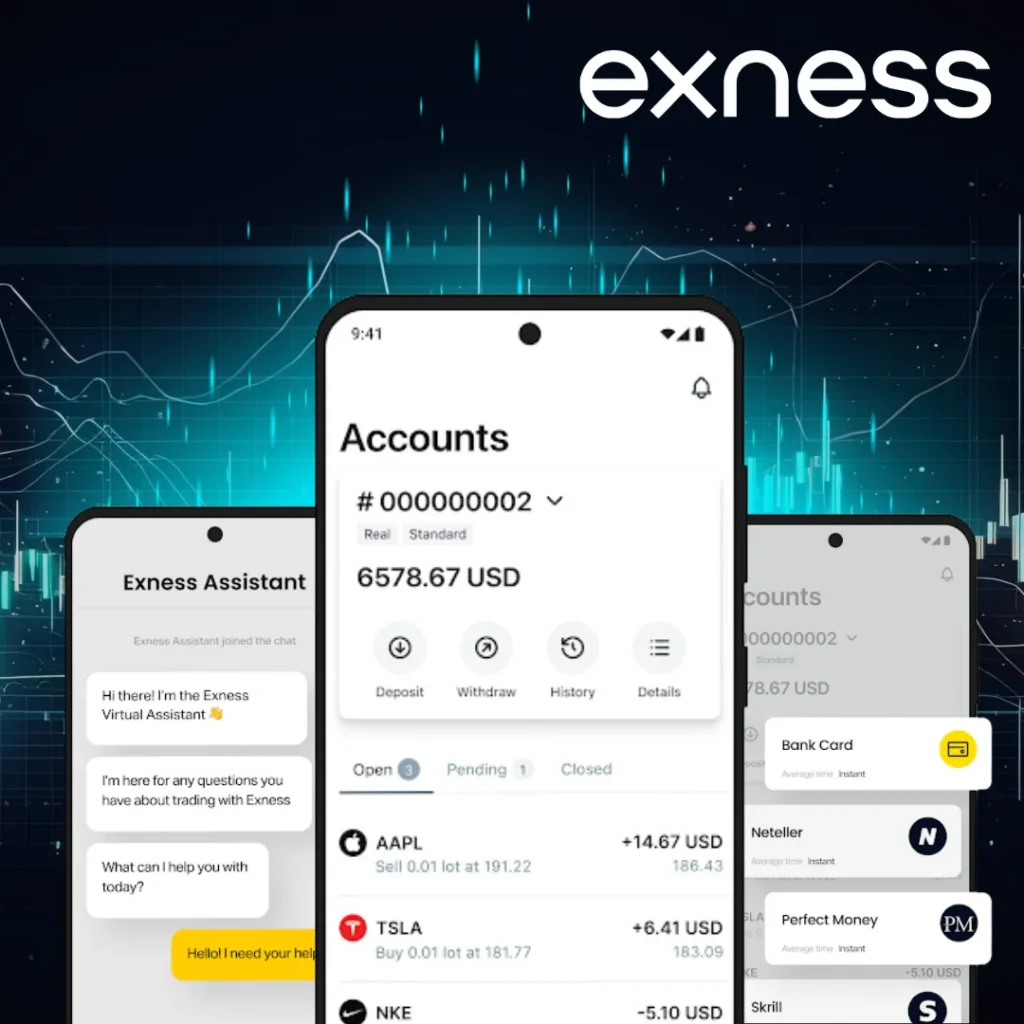

Mobile Trading for African Users

Exness provides trading access through mobile applications optimized for African markets. The application works on most devices with minimal connection requirements to accommodate various network conditions. It functions across Android and iOS systems with a compact size of approximately 100MB, serving as a primary trading tool due to wider mobile coverage compared to fixed internet.

Account Creation Process

Users start by visiting the official website or downloading the mobile application. The system requests basic information including email, password, and country selection. After registration, users receive a verification email with an activation link, giving access to the Personal Area where they can choose account types based on their trading goals.

Account Types Available

Standard accounts operate with floating spreads from 0.3 pips with no commission and $1 minimum deposits. Professional accounts use a commission structure with zero spreads on major currency pairs, targeting active traders with higher minimum deposits. Cent accounts denominate trades in cents instead of dollars, allowing smaller positions with reduced risk.

Verification Requirements

Exness implements a two-tier verification process. Basic verification requires government-issued identification documents. Advanced verification adds proof of residence through utility bills, bank statements, or official correspondence issued within three months. Document processing typically completes within 24 hours during business days.

Funding Methods

The platform supports various payment systems including mobile money services (M-Pesa, MTN Mobile Money, Airtel Money), bank transfers with major financial institutions, electronic wallets (Skrill, Neteller, Perfect Money), and cryptocurrency deposits (Bitcoin, Ethereum, Tether). Minimum amounts vary based on the method chosen.

Mobile Trading Features

The application provides complete functionality including account management with real-time metrics, all order types available on desktop platforms, technical analysis tools with multiple timeframes and indicators, and configurable notifications for price movements and margin levels.

Trading Instruments

Trading options include currency pairs (including USD/ZAR, EUR/ZAR, USD/NGN where available), commodities covering metals, energy products and agricultural items, major global stock indices, and cryptocurrency CFDs. Leverage varies across instrument categories based on regulatory requirements in each jurisdiction.

Trading Hours and Conditions

Forex markets operate 24 hours, five days per week (GMT+2). Commodity trading hours vary by product and reference exchange. Cryptocurrency CFDs trade continuously including weekends with potential liquidity variations during off-peak hours.

Mobile Platform Security

Security features include two-factor authentication, data encryption for transmissions between devices and servers, automatic logout for inactive sessions, and biometric security options (Touch ID/Face ID) on compatible devices.

Connection Requirements

The application functions on both high-speed and limited bandwidth networks with data consumption optimized for usage-based pricing models. Minimum connection speed starts at 128 Kbps, with a “low data mode” setting for restricted data plans and offline capabilities for viewing previously loaded information.

Support Resources

Support options include live chat through the mobile application and website with average response times under one minute, email support for complex queries, country-specific telephone numbers, and WhatsApp support in regions where widely adopted.

Mobile Trading Comparison

| Feature | Exness Mobile | Web Terminal | Desktop Platform |

| Chart Analysis | Basic to intermediate | Intermediate | Advanced |

| Order Types | All standard types | All standard types | All types including custom |

| Execution Speed | Fast | Very fast | Fastest |

| Data Usage | Optimized | Medium | High |

| Device Requirements | Minimal | Browser only | More demanding |

FAQ: Preguntas Frecuentes

How do I handle trading during unstable network connections?

Set protective stop loss orders before connection quality deteriorates. Use pending orders rather than market orders when possible. Enable push notifications for alerts during intermittent connectivity. The application will submit queued transactions when connection restores. Consider lower timeframe charts which require less data.

What solutions exist for mobile payment rejection issues?

Ensure payment details match exactly with your Exness account information. Verify transaction limits and international payment permissions with your provider. Try smaller amounts as some providers impose single transfer limits. Maintain alternative payment methods when possible.

How can I trade during power outages common in some regions?

Keep mobile devices fully charged and use power banks for extended outages. Scale down chart timeframes and indicators to reduce battery consumption. Close unnecessary background applications. Set wider stop loss levels to account for potential execution delays during power restoration.